child tax credit after december 2021

A small number of CTC recipients are opting for a lump-sum payment that the IRS. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022.

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. CTC payments are going out in monthly increments through December. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim.

It also provided monthly payments from July of 2021 to December of 2021. Expanded child tax credit benefit nears lapse as December checks go out By The Associated Press Published. The expanded child tax credit expires Friday after Congress failed to renew it December 30 2021203 PM ET Deepa Shivaram Twitter Enlarge this image The continuation of the child tax credit.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Lets say you qualified for the full 3600 child tax credit in 2021. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. See what makes us different. If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December.

The 2021 temporary expansion of the child tax credit CTC was unprecedented in its reach lifting 37 million children out of poverty as of December 2021. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Free means free and IRS e-file is included.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. The 2021 temporary expansion of the child tax credit CTC was unprecedented in its reach lifting 37 million children out of poverty as of December 2021. 15 with the Internal Revenue Service IRS depositing most checks by.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. It provided families with up to 3600 for every child in the household under the age of six and up to 3000 for every child between the ages of 6 and 17. 15 2021 at 200 AM EST.

Eligible families are receiving 250 a month for each child aged 6-17 and 300 a month for each child under age 6. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The last child tax credit payment of 2021 is scheduled to go out on Wednesday Dec. Learn More At AARP. We dont make judgments or prescribe specific policies.

Will send them in 2022 after they file their 2021 federal tax returns. Max refund is guaranteed and 100 accurate. You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return.

112500 if you are filing as a head of household. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

The Family Security Act 2 0 Creates Winners And Losers First Focus On Children

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Parents Guide To The Child Tax Credit Nextadvisor With Time

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

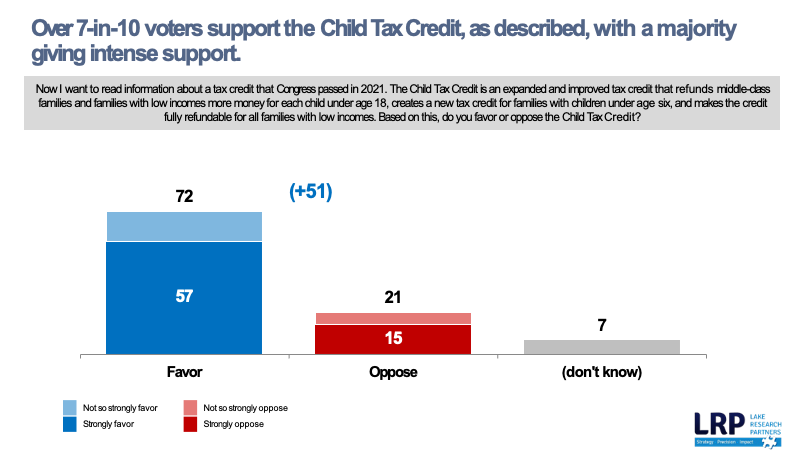

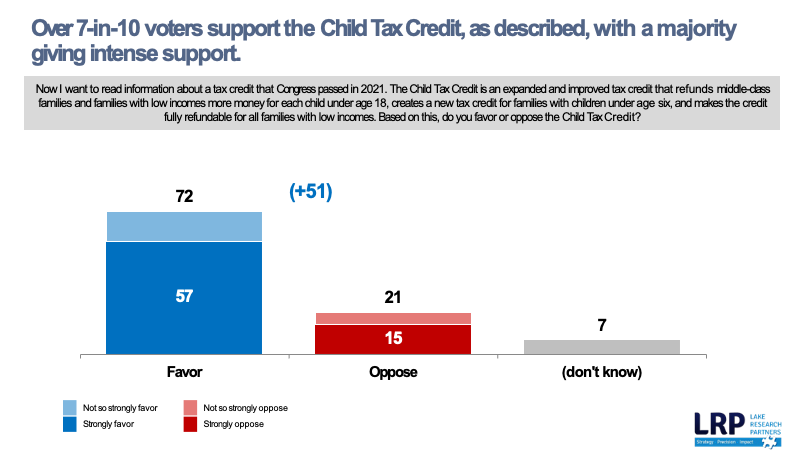

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

2021 Child Tax Credit Advanced Payment Option Tas

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Banking Financial Awareness 19th December 2019

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet